ATX™ 2016

Rollover Returns from Last Month/Quarter

You can roll over returns from the previous month or quarter, so you don't have to re-key the return. When you roll over a return from the last month or quarter, the system creates a new return with the same forms and client information, but with the new period’s reporting dates.

We strongly recommend updating your current and prior year software before rolling over returns.

Payroll returns are not supported in ATX 2016. If you have not yet installed the 2016 W2 and 1099 or Payroll Compliance software, see W2-1099 or Payroll Compliance.

To roll over a monthly or quarterly return to the next period:

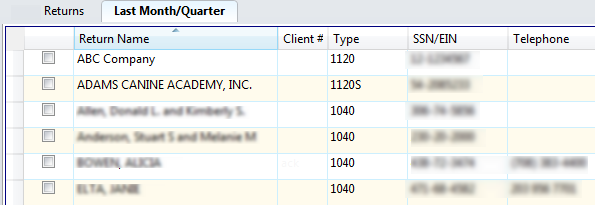

- In Rollover Manager, click the Last Month/Quarter Tab.

Last Month/Quarter tab

- Select the check boxes for the return(s) you want to roll over.

- Do one of the following:

- Click the Rollover button on the toolbar.

- Click the Rollover menu; then, select Rollover Marked Returns.

The Rollover Results dialog box appears.

- Click Close.

See Also: